As part of the thinking and learning process, I will try to capture as much as I can in option strategies. This lead me to Monsanto (MON) which have be hated by the market and everyone else including columnist at Barron's. We took position in this name around $70 to find it move one direction, down. At $55, I thought I'd take a cheap shot at this stock rebound through an out right Call option.

My goal is not to take delivery of the shares but plan to sell back the options at a (hopefully) higher price. This is because I don't have $6,250 to take delivery of the shares. Using options allow me to risk up front premium which I paid $50 for the right to buy MON anytime before June 18, 2010 at $62.50.

The breakdown

MON @ $55.50

$62.50 Call (June 10') => $0.50

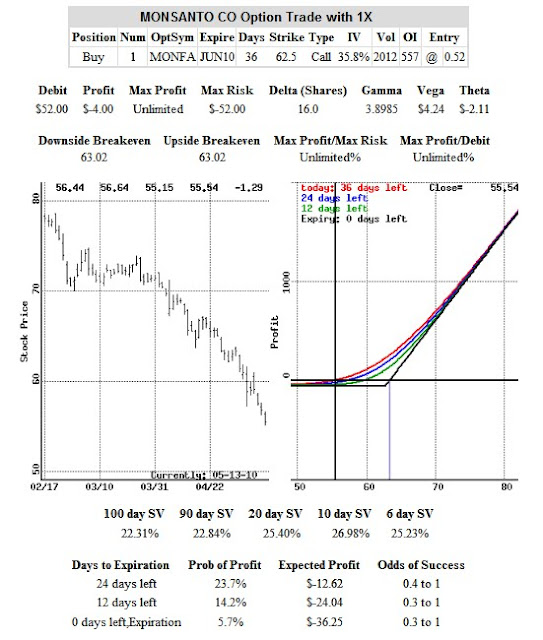

Chart below shows the option data.

I have approximately 35 days for MON to rise 13%. This sounds like a tough task and it may very well be, but MON has fallen 18% over the same period going to 4/7. Roughly speaking, I expect the stock to retrace 60% of the decline. Chart below shows the macro view of MON.

The key to this trade is to consider all your premium to be worth nothing! That's correct, after placing this trade, I consider myself losing $50. If I regained that money back or profit, then I gained. My view is that the loss ($50) is minimal to the potential gain, I am willing to speculate.A quick technical look and you can see that RSI is at extreme oversold of 16.02. Then again, I said the samething to myself at RSI 20.

This trade should resolve much sooner than my previous strategy on QCOM so check back sooner than later - Art

Thursday, May 13, 2010

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment